Published on: 05/11/2021

CryptoPunk’s ‘Wash Sale’ Uncovers the Sinister Side of NFT Sales

For any onlookers, the non-fungible token (NFT) space has been abuzz with activity, hype, and speculation over the past few months. We have seen digital art pieces selling for hundreds of millions of dollars at auctions, paving the path for what seems to be a multitude of early retirees as the NFT craze rages on.

Granted, even veteran crypto enthusiasts are gawking at the lucrative opportunities that lie in the NFT market and are jumping on the bandwagon in hopes of striking it big albeit the slim chances.

Since Beeple’s sale of an NFT collection called “Everydays” that sold for $69 million, multiple NFT projects have come forth outselling Bepple’s digital art collection by far.

As records show surging NFT sales past the $10 billion mark in the 3rd quarter of 2021, CryptoPunk’s latest $500 million NFT sale is perhaps the pinnacle in terms of NFT-based digital art valuation; or is it?

CryptoPunk’s Wash Sale

News about CryptoPunk’s $500 million NFT purchase has been making headlines lately albeit with concerns from analysts. The mind-boggling sale was first reported on the CryptoPunk sales bot that said NFT CryptoPunk number 9998 was sold for 124,457 ETH.

The unusual transaction was met with doubt and speculation from the crypto community as analysts pointed out that the sale was made by the same individual according to their wallet address.

Some have rationalised the sale as a use having fun. The explanation for this is that the user must have borrowed 500 million DAI from a flash loan DeFi protocol to purchase the NFT. Flash loans are a type of unsecured loan where a lender issues capital to a borrower, and that borrower has to pay back the loan within that one transaction. For instance, the buyer of the CryptoPunk 9998 would borrow 500 million DAI and use it to buy an NFT only to sell and return the loan before the duration of the DAI transaction expires. It is a sophisticated concept that has since grown hugely popular among DeFi and NFT enthusiasts.

What are CryptoPunks?

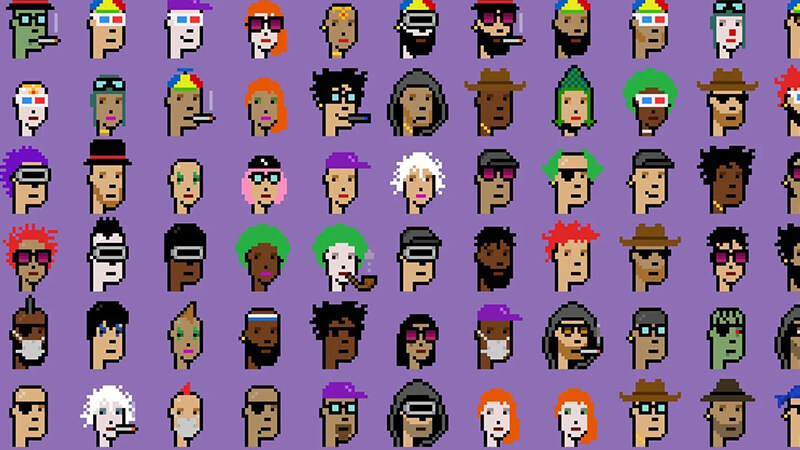

The idea behind CryptoPunk started as an experiment conducted by John Watkinson and Matt Hall in 2017. The two software developers wanted to create a program capable of generating multiple avatars that were unique and rare. The result was a total of 10,000 24 by 24 pixelated 8-bit style avatars in the form of NFTs.

Inspired by the British punk culture in the 1970s, CryptoPunks have since become the predecessor of many NFT projects. Watkinson and Hall founded Larva Labs as a platform for creative technologists to experiment with new ideas as well as actively run the CryptoPunk project.

While every avatar in the collection is unique, some have a higher level of rarity than others. Each avatar comes with unique programming that gives it different traits. Back in 2017, CryptoPunks sold for as little as $1 to about $30 each. AS NFT sales surge across the board so to did the price and CryptoPunks. Currently, a single NFT could be worth millions of dollars, especially with the rising price of Ethereum.

Some rare NFTs in the CryptoPunk collection has garnered high valuations with noteworthy sales, such as that of June this year, where an Israeli entrepreneur and billionaire bought a CryptoPunk for a whopping $11.7 million. Also, a clever user was recently able to net roughly $80,000 in less than a day after buying a CryptoPunk for next to nothing after the seller made an erroneous listing of the NFT. These are just a few of the many headline-hitting tales surrounding CryptoPunks and NFTs in general. However, none compares to the size of the $500 million NFT sale.

Even Larva Labs crossed out the transaction as invalid noting that the sale was made by the same person in a flash loan. Could this and many other incidences be indicators of sinister money laundering bubbling underneath the facade of an NFT market dominated by wealthy and bored crypto whales?

See also: NFT Games Meaning: what is NFT in gaming?

NFTs and Money Laundering

While multiple NFTs have been sold legitimately for a high ticket, Crypto sales such as the one with CryptoPunk 9998 are categorised as wash sales or wash trading. An NFT wash sale is when a trader buys and sells the NFT to feed misleading information to the market.

In traditional finance, instances where the same individual is the buyer and the seller would raise serious red flags of collusion to commit money laundering. Wash NFT transactions such as the one seen with the CryptoPunks NFT have brought about concerns about the use of NFTs to launder money.

Since most NFTs are subjective digital art, regulators barely raise criticism about suspicious activities in NFT sales, yet experts warn that substantial amounts of speculative money flowing into the markets is always a cause of concern.

According to Mr.Whale, an early bitcoin adopter and crypto commentator, buying an NFT from oneself using illicit funds is an easy way of avoiding taxes, laundering money, and claiming the funds are clean profits front the sale of legitimate art.

Mr. Whale further explains how this can be achieved where a bad actor can buy a random NFT for, say $100. The user would then list the JPEG NFT in a whitelisted auction that only lets them be the participant. In the auction, the user can set up another account for the buyer side of the transaction. Using illicit money, the user can buy the NFT from their seller account and claim that the profits earned are clean.

Conclusion: The Future of NFTs and Regulations

Expert NFT investors such as Cat Graffam who is an adjunct faculty member of Lasell University’s Art and Desing Depa apartment agree that NFTs leave room for money launders to thrive.

Even though projects such as CryptoPunk are legit NFT projects, their decentralised digital art-based design makes it much easier for criminals to clean up dirty money by moving funds around decentralised finance platforms. This adds to the uncertainty of NFTs despite their promising valuations.

While most NFT platforms at the moment don’t require KYC (know your customer) or AML (anti-money laundering) procedures, onlookers such as Mr. Whales believe that this is going to change in the future as regulators start to pay keen attention at NFT marketplaces.

-

Crypto Gaming News // 2021-11-05

Dvision Network Review